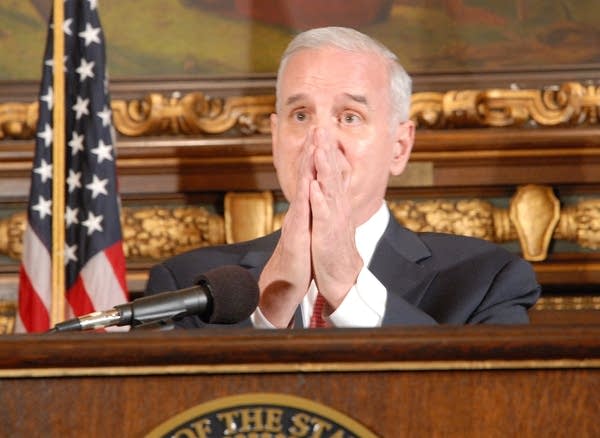

Dayton vetoes GOP-backed tax bill

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

Gov. Mark Dayton has vetoed a package of business tax breaks, including a freeze on statewide property taxes for businesses, saying it relies on budget reserves to cover the cost of the tax relief while the state faces a financial problem in the next budget cycle.

Republicans reacted angrily to the veto. Senate tax committee chair Julianne Ortman said Dayton lost trust with lawmakers by turning down their top priority for the legislative session. She warned that there may be consequences in the waning days of the session, as the House, and possibly the Senate, take up a Vikings stadium bill.

"This was our tax relief and jobs bill. These were our ideas, that he said that he would agree to. He said he would work with us. And he pulled the rug out from under us, when we presented a very good, high quality, bipartisan bill," she said.

Republican Senate Majority Leader Dave Senjem also expressed disappointment with the veto, but said that he hoped Dayton would reopen talks with lawmakers.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

In addition to the freeze on business property taxes, the vetoed bill included an upfront sales tax deduction on business equipment purchases and increased funding for research and development and Angel Investment tax credits. There was also a local tax provision aimed at a Mall of America expansion.

The governor vetoed the tax bill within hours of receiving it.

Dayton said the bill's focus on businesses made it "unbalanced," and its price tag made it "fiscally irresponsible." He said the bill would reduce the state's budget reserves this year and add $145 million onto next year's projected budget deficit.

Dayton said the tax bill was another example of his "profound disagreements" with Republican leaders, whom he said were unwilling to compromise.

"That's been the problem with this dynamic last year as well as this year. Their version of compromise is when we do it their way," Dayton said. "That's not compromise. That's not negotiation."

The governor told reporters that he wanted the bill out of the way and for it not to become a bargaining chip for other unresolved issues, including the stadium bill and a bonding bill. But Dayton has already heard about some lawmakers linking their stadium vote to the fate of the tax bill, he said.

"I made it very clear earlier this week to legislative leaders that I would not sign a bad tax bill for the stadium. I would not make that kind of trade. I'm not going to jeopardize the fiscal stability of the state now and in the future for that project, and because also I don't think it should be related in any way whatsoever," Dayton said. "The stadium is not about me. It's about thousands of Minnesotans who are now unemployed who would have jobs if that project goes forward."

Despite their disappointment and frustration with the veto, Republican leaders indicated they were willing to try again to work out a tax agreement with Dayton. House Speaker Kurt Zellers said he still wants to find something that the governor can sign. Senate Majority Leader Senjem said he does too.

"You know, we've got a couple of days left. It's not lost. We can work together. But we've got to put this kind of stuff aside. We've got to be willing to work together," Senjem said. "Again, taking down this tax bill, red veto pens don't move this state forward. Good work does. We've got a chance to do some good work."

Dayton said he is willing to resume negotiations on a tax bill and even pointed out the elements of a potential compromise on property tax relief, as long as it benefits all property owners, and not just businesses. Dayton told reporters he would be willing to accept a tax bill that has some influence on future budgets, but at a significantly smaller level than Republicans have proposed.