20 cents vs. four nickels: Messaging matters in gas tax debate

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

Gov. Tim Walz didn't shy away from the figure: His transportation finance plan would eventually boost the per-gallon gas tax by 20 cents, which he deemed essential to fix "crumbling roads and bridges that risk our safety and keep away businesses."

"This is not a choice between having a gas tax or not," he said.

Critics of the proposal quickly embraced the figure, too, and churned out graphics and gas-pump images, warning of a sudden, sharp spike.

"You're going to see that Minnesotans are going to say, 'Wow. That's an extreme approach to solving a problem,'" said House Minority Leader Kurt Daudt, R-Zimmerman.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

Even some allies of the governor, such as House Tax Committee Chair Paul Marquart, flinch at the size of the increase Walz put on the table.

"It's kind of sticker shock when you hear 20 cents right there," said Marquart, DFL-Dilworth.

The messaging battle was set. Glossed over was the fact that the jump to the existing 28.6 cent tax wouldn't happen all at once, or that all the new proceeds would not be used to chop down a backlog of projects.

As proposed, additions to the tax would be spread out through 5-cent-a-gallon bumps — the first this September and the rest spread paced out about every six months. After that, Walz wants to connect the tax to some measure of inflation.

"Sometimes how you frame things makes a difference," Marquart said.

For the record, Marquart said 20 cents overall is too high. But he regards something half that size as "in the ballpark" as long as other new and reliable road money is blended in.

The gas tax has been the backbone of Minnesota's transportation finance system for decades. Proceeds are constitutionally dedicated to roads, bridges and some connected costs, such as the highway patrol. It's only one component of the Walz's plan — with higher registration fees and vehicle sales taxes also in the mix.

Transportation Commissioner Margaret Anderson Kelliher traveled to Moorhead, Minn., on Tuesday to press the case for more money, highlighting a railroad underpass and other area projects local officials have long sought.

She acknowledged that detractors are honed in on the full tax amount, but said her agency will work to explain the implementation better.

"We're going to continue [to] produce materials that help people understand the way it gets phased in but also where the dollars go," Kelliher said.

On that last point, Kelliher estimates that about 5 to 6 cents of the proposed 20-cent boost would get projects to ease congestion and improve safety features done more quickly. She said 7 cents would be used to swap out transportation spending that now comes out of the general treasury, freeing up $450 million for other state-backed programs. The rest, she said, would pay off past highway borrowing or support new bonds.

Defenders of the administration's plan include Jason George, business manager for the International Union of Operating Engineers Local 49. The union is a key ally in the debate because it has made political inroads with Republicans in a way other labor groups haven't.

George said no matter how the governor outlined his proposal, it was going to come under fire.

"If they put out an incremental approach, it was going to get slammed. If they put out the whole 20 cents, it was going to get slammed," George said. "It's just part of the game."

Prone to swings

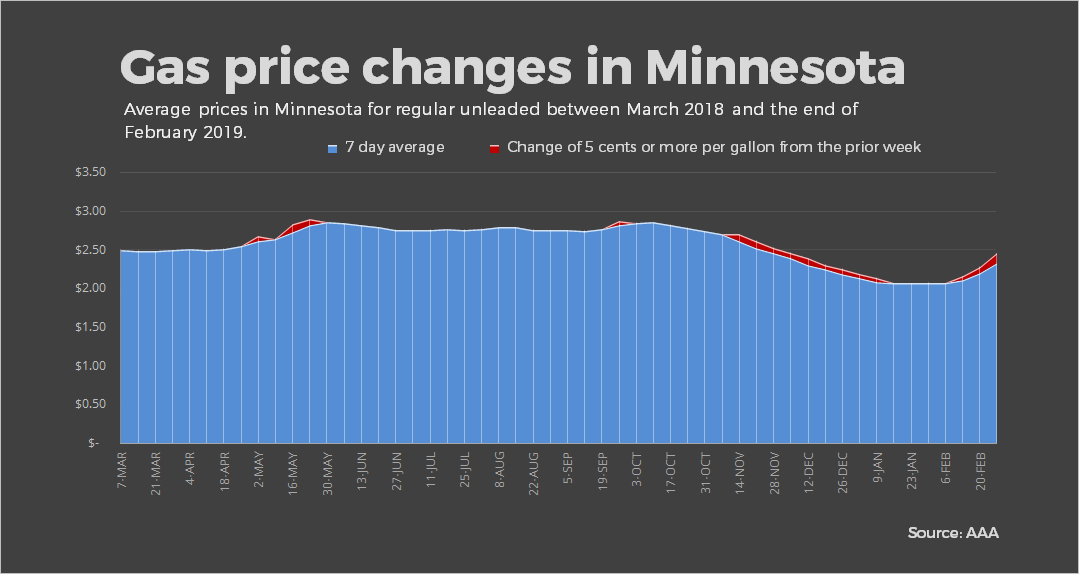

Anyone who visits the pump knows that gas prices can swing hard. MPR News analyzed the statewide average price for unleaded fuel for the last year.

There were 14 weeks when prices moved by at least 5 cents with the upswings more pronounced than the dips.

"The price of a gallon of milk, so to speak, doesn't go up and down quite as much as a gallon of gas," said Nick Jarmusz, the regional public affairs director for AAA.

The auto club keeps tabs on prices and other data on driver behavior. Jarmusz said it takes a lot for drivers to park their cars to avoid filling up.

"We don't really see people making dramatic adjustments in their driving patterns until we see prices pushing $4 a gallon at least," he said. "Anything less than that, you'll hear a lot of grumbling about it but you'll also hear people simply finding other places in their budget to shift around to accommodate for the increases."

Jarmusz said a 20-cent increase could carry a bigger psychological sting than an incremental boost.

Gas tax proposals are on the table this year in Wisconsin, which has a Democratic governor, and Ohio, whose government is led by a Republican. Already approved increases will take effect this summer in Rhode Island, South Carolina and Tennessee.

Gas buyers pay about 33 cents per gallon in state taxes and fees in Wisconsin. It's 30.5 cents in Iowa; 30 cents in South Dakota; but only 23 cents in North Dakota.

Minnesota lawmakers last approved a gas tax increase in 2008 — with the 8.5-cent hike done in seven installments that stretched into 2012.

Lance Klatt, executive director of the Minnesota Service Station and Convenience Store Association, said gas station owners oppose raising the tax.

His association has asked to meet with Walz about ways to make his proposal more palatable. That might involve an accompanying relief plan to shield station owners from credit card transaction fees. Credit card companies take a percentage of every swipe.

"We are being punished for collecting the government's money," Klatt said.

'Dying star'

Senate Transportation Committee Chair Scott Newman, R-Hutchinson, said the gas tax is on the verge of becoming obsolete.

Cars are more fuel-efficient. Some take no gas at all.

"Why should we, in the long term, tie one of our primary funding sources to what I would consider a dying star? It isn't going to be there in the future," Newman said.

He wants more of the transportation money to come from the general treasury. Critics of that approach argue that would put road and bridges in direct competition with schools and nursing homes.

Newman declared his gas tax opposition even before he knew what Walz would propose last month.

"Would people notice if we increased their gas tax by 5 cents or 10 cents? Maybe, maybe not. I don't know." Newman said. "I can tell you I believe that most people in Minnesota are against an increase in the gas tax."

That's not how Luverne Mayor Pat Baustian sees it.

He said some of the main state routes in the southeastern Minnesota city are showing wear after years of pounding by heavy farm equipment that carries tons of hay bales, hogs and liquid manure.

"Highway 75 is our particular road. It's falling apart. It's crumbling," Baustian said.

Without a revenue infusion, Baustian said he's been told by transportation planners not to expect a major rehab until 2023. His own daily commute to work covers 60 miles and he's more than willing to bear the brunt of a higher gas tax.

"Twenty cents on a 15-gallon tank and I fill up once a week. Three bucks a week for a much better road. You know what? I'm all in," Baustian said. "Who do I write my check out to?"

MPR News reporter Dan Gunderson contributed to this story.