Some DFLers distance themselves from Dayton's tax plan

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

Minnesota's gubernatorial candidates stake their campaigns on distinct proposals to solve a projected $5.8 billion state budget deficit.

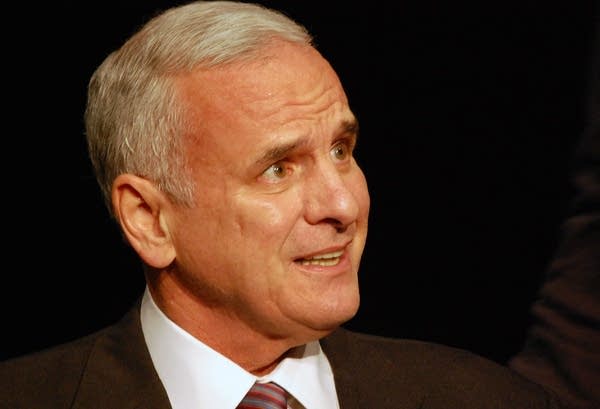

DFL candidate former U.S. Sen. Mark Dayton wants to raise income taxes on upper earners, but you won't hear about it from some DFL legislative candidates.

Some are also promising to vote against the proposed income tax increase if Dayton is elected governor.

"I don't talk about that," said DFL state Sen. Terri Bonoff of Minnetonka, who spent a recent afternoon knocking on doors in in Plymouth, a mostly Republican area of her suburban district.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

Bonoff is a moderate Democrat, and she said her re-election bid depends on the support of independents and some Republicans.

In her conversations with voters, Bonoff stresses the need for broader tax code changes, including the sales tax expansion proposed by Independence Party gubernatorial candidate Tom Horner.

"I have a lot of respect for Mark Dayton. But I have my views about what we ought to do with regard to taxes, and it's not about protecting the rich," she said. "It's about right now we have too much reliance on the income tax, and as the demographics change in our state and our folks are getting out of the workplace, more and more seniors, they don't have that kind of income stream.

"If we're too reliant on the income tax, I think we're going to find ourselves in this same mess three years from now."

The concern is similar in the east metro suburbs. Sen. Kathy Saltzman, DFL-Woodbury, who's locked in a tough re-election fight, also stresses her independence on tax issues. She's voted against previous attempts to raise income taxes on upper earners.

Saltzman hasn't endorsed a candidate for governor, but she's met with Dayton and Horner. Saltzman said she asked Dayton to be open to other tax ideas, not just taxing the rich.

"I believe that it's not about targeting one group or one group of services," she said. "We really should be looking at an overall tax reform policy. That would be the most responsible way to approach this."

Saltzman said Republican Tom Emmer's cuts-alone approach to the budget is unrealistic. She favors a balanced approach that includes some revenue, and is open to a sales tax expansion as part of a broader reform of the tax code.

But Saltzman said she will not support the Dayton tax plan. "It will be very difficult to get it by me. I would say he won't get it by me. He will note get my vote," she said.

In Golden Valley, DFL state Rep. Ryan Winkler is also avoiding the "tax the rich" message in his re-election campaign, but he isn't ruling it out either as part of a budget solution.

Winkler said he agrees with Dayton on the need to raise more tax revenue to fund education and other critical programs.

"I might not agree with him in all details about where all the revenue should come from. I think more of a mixed approach is probably more likely and better," he said. "But those are just differences in detail. I think the overall goal of raising revenue fairly to fund important program is shared by virtually all Democrats."

For his part, Mark Dayton said he understands the concern, particularly in suburban districts with a higher proportion of voters with higher incomes. He said the feedback he gets from DFL candidates in low-income rural districts is just the opposite.

"No tax increase is popular with everyone, and I wouldn't be proposing anything if it weren't necessary to deal with an almost $6 billion deficit," Dayton said. "But the facts are, this is not a question of tax or no tax. It's which tax on whom, and I think my plan is a fairer one."

Dayton said he is hoping to have a DFL House and Senate to work with as governor. To that end, he said, DFL candidates need to do whatever is in the best interest of their districts regarding taxes.