Lenders now working to help homeowners avoid foreclosure

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

It's been two months, but Janice Davis still gets emotional when she remembers the day she got the letter telling her that her mortgage payment would go down.

"I had my daughter on the phone, and I opened it and I started screaming," Davis recalled. "My interest rate went down to 5.25 percent, and I just started screaming. I mean, when I really found out what I was reading I just screamed. My daughter was like, 'What's wrong?' and I said, 'I think my mortgage went down!'"

Like many homeowners over the past few years, Davis refinanced her south Minneapolis home more than once, with a subprime adjustable rate mortgage. From the start, it had a high interest rate that she couldn't afford.

She says her mortgage broker convinced her that she could lower her rate in the future by refinancing again. But the rate went up and up, and she quickly fell behind.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

Davis, whose job as a baggage handler at Northwest Airlines was her family's sole source of support, says it got harder and harder to pay her bills. Eventually, she went into foreclosure.

Her lender, Countrywide, repeatedly denied her requests for a loan modification. Things got so bad, Davis says, she began to make peace with the idea of losing the home she's lived in for 14 years.

But after a year of refusals, Countrywide finally reversed course. Davis says the deal they offered in July was better than she ever imagined. Countrywide lowered her interest rate from about 10 percent to a fixed rate of 5.25 percent.

"It's a fixed. They can never touch it again. Nothing can move! Twenty years from now, I'll still be paying the same price," Davis said.

The lower interest rate brought her monthly payment down by about $400. Davis says it's already made a big difference in her ability to make ends meet.

Davis is not alone in trying to lower her interest rate. The numbers show it's happening nationwide.

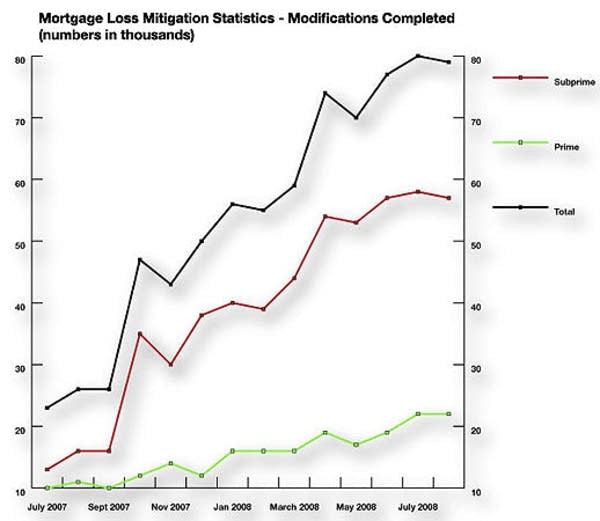

Hope Now, a group made up of lenders, servicers, and advocates, reports there were 79,000 loan modifications nationwide in August. That's triple what it was at the same time last year.

"It feels good now to be able to pay your mortgage."

Habitat for Humanity's Cheryl Peterson, who helped Davis get her mortgage changed, says the economic crisis is forcing lenders to consider modifications they would've just denied in the past.

"The more money that they have lost, they've been more willing to do loan modifications," said Peterson. "That is because, ultimately, it is in their best financial interest not to foreclose on the homes and the portfolios and assets they have."

Foreclosures are estimated to cost lenders about $40,000 each. That's on top of the legal and marketing expenses involved in reselling a foreclosed home.

Bank of America spokesman Rick Simon says the lender started taking a different approach to foreclosure about a year ago, shortly before it bought Countrywide. That's because foreclosures are costly for everyone involved -- the borrower, the community, the lender and servicer, and the investors who own the mortgage debt.

"Very, very costly to the servicer and the investor," Simon said. "If we can anticipate that we are going to have these increases in foreclosure rates, the thinking is now more and more, why don't you take some of that cost and move it foward and put it toward home retention."

Mortgage modifications at Bank of America are already up four times this year over last year. Like others in the industry, Bank of America is now more willing to lower borrowers' principals and interest rates.

Simon says that was rare in the past, because the strong housing market made it easy for homeowners to refinance or sell their homes. But now that credit has tightened and home values are dropping, that's less of an option.

Looking back, homeowner Janice Davis says she knows now that she shouldn't have accepted an adjustable rate mortgage. But now that her interest rate has been fixed to a level she can afford, she says the long fight was worth it.

"It feels good now to be able to pay your mortgage," Davis said.

It's unclear whether this wave of loan modifications will help ease the national credit crisis. So far, there doesn't seem to be any indication of that.

What is clear is that as more adjustable rate mortgages reset to higher interest rates, the number of homeowners seeking help is unlikely to go down anytime soon. Lenders advise anyone falling behind on their mortgage to contact them right away.