St. Paul's insurance policy paying off as RNC lawsuits loom

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

Long before the convention came to town, St. Paul city officials were thrilled by the possibilities of being hoisted onto a world stage.

But they also anticipated the potential for lawsuits -- lots of them.

City attorney John Choi and his colleagues flew out to New York and Philadelphia, the cities that hosted the two previous RNCs. The purpose of their visits was to glean some lessons learned.

"One thing that was pretty clear -- just given the magnitude of a national security event, and just given all the human interactions that relate to managing risks that we do every day as part of the city attorney's office -- it was pretty clear that having some sort of insurance policy would be prudent," Choi said.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

In fact, four years after New York hosted its convention, litigation has cost the city about $8.2 million.

But in January of last year, St. Paul brokered a first-of-its-kind deal for a national political convention.

The city required the Minneapolis-St. Paul host committee to buy insurance costing $1.2 million that would pay up to $10 million in damages. The policy doesn't have a limit on legal expenses.

That means St. Paul won't have to tap its self-insurance fund unless the damages exceed $10 million. The policy also covers other cities that provided officers for security during the RNC.

Some activists say the liability policy gave cover for individual officers to use excessive force.

But Choi calls those claims "flawed logic."

"We all have insurance on our houses and on our vehicles. And we don't purposely get involved in accidents, we don't burn down our house, just because we have insurance," he said.

The city's risk manager, Ron Guilfoile, says St. Paul's approach will become more common, especially as more mid-size cities get into the convention business. For example, Tampa and Cleveland also submitted bids to host the 2008 RNC.

Guilfoile said of future host cities: "I think they'll be looking for doing the same practices that we did. For a smaller public entity to take on the potential financial risk that could be involved with an event like a convention, I just don't see them having the ability to do that."

The agreement has won praise from both everyday citizens and legal experts, who note that the state liability cap that came into play after the I-35W bridge collapse wouldn't apply to police-misconduct claims. That's because claims against law enforcement typically fall into federal court, where the statutory caps don't apply.

The state liability cap is currently set at $1.5 million per incident.

But at least one attorney thinks the insurance policy could be problematic for the city.

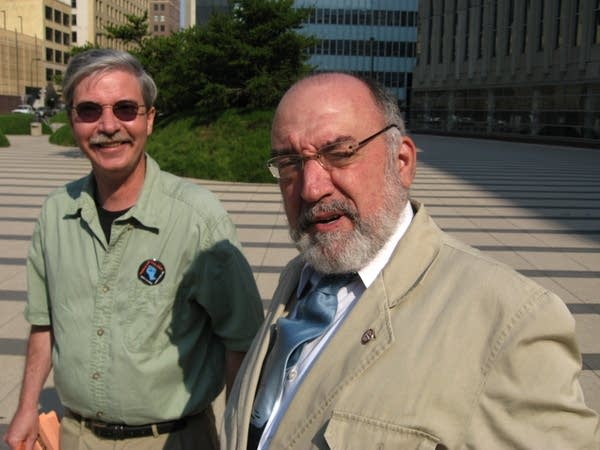

Ted Dooley is representing two men who say they'll sue St. Paul, alleging officers violated their constitutional rights. One of Dooley's clients is an anti-war protester who alleges an officer shot him at close range with a projectile, severely bruising him.

Dooley says the officer's alleged actions demonstrated gross misconduct -- which he says would not be covered by the city's insurance policy.

"Shooting a guy from five feet away with an intentional shot -- I have a hard time seeing how that is just negligence," he said. "It's an intentional act. It was very directed. I don't see that an insurance company would pay for that kind of thing."

But that's a view not necessarily shared by Bob Bennett, a high-profile lawyer who has represented victims of police brutality in the Twin Cities. Bennett says it would be tough to prove an officer showed gross negligence, unless the officer did something truly "odd," such as randomly firing a gun into a crowd.

Bennett also doesn't think the $10 million policy will have any bearing on whether would-be plaintiffs and their attorneys will file suit.

"I wouldn't base any case decision on whether a policy existed or not," he said. "I would use the same criteria that I would use, regardless. You want to bring meritorious cases. Why would anybody want to bring a frivolous lawsuit?"

Bennett says he hasn't picked up any clients alleging police brutality during the convention. But he says it may be too soon to know for sure.

Four years after the last RNC, hundreds of legal claims are still pending in New York.